Are accountants truly swimming in wealth, prompting you to ponder the path to joining their ranks?

This question has lingered in the minds of many, perpetuating the idea that accountants live lavishly due to their financial prowess.

Don’t worry, you’re not alone! In this blog post, you’re about to take a friendly and enlightening journey. I’ll unravel the myth, break down stereotypes, and explore the real financial landscape that accountants navigate.

- Are Accountants Rich?

- Can Being An Accountant Make You Rich?

- Are Accountants Financially Educated?

- Will an Accountant Ever Be Rich?

- Are Chartered Accountants Rich?

- Alternative Streams for Accountant Wealth

- Is Accounting A Future Job?

- Do accountants have a lot of free time?

- What Are The Disadvantages Of Being An Accountant?

- Conclusion: Are Accountants Usually Rich?

Are Accountants Rich?

To give you a short answer: Yes and no.

The idea that all accountants are rich is not entirely true. While some accountants earn substantial incomes, it’s not a universal rule. Factors like experience, specialization, and location play a significant role in determining an accountant’s earnings.

So, grab a cozy seat and get ready to understand and learn how accountants ride the wave of riches.

Can Being An Accountant Make You Rich?

The Perception vs. Reality

The media often portrays accountants as individuals living in opulence, surrounded by luxury cars and extravagant vacations. But the truth is far more nuanced. The perception of accountants as wealthy individuals can be attributed to media stereotypes and societal biases that equate financial success with specific professions.

However, let’s examine the cold, hard facts from labor statistics.

While this is a respectable income, it’s important to note that this figure encompasses both entry-level positions and experienced professionals.

Geographic location, industry specialization, and education levels play a significant role in determining an accountant’s income. For instance, the cost of living and salary expectations in New York might differ substantially from those in a smaller town.

Do Accountants Actually Make Good Money?

There are different types of accountants who earn different amounts of income, annually. This table is based on an average salary.

| Type of Accountant | Average Annual Salary (US) |

|---|---|

| Chartered Accountants | $89,000 – $119,000 |

| Real Estate Accounting | $75,000 – $110,000 |

| Public Accountants | $53,000 – $96,000 |

| Tax Preparation | $54,000 – $79,000 |

| Financial Analysts | $85,000 – $102,000 |

Can I Make 100k as an Accountant?

To give you an easy answer, yes you can. Especially when you specialize in becoming a chartered accountant. They are the richest accountants of the bunch and can easily make more than $100k per year.

What Is The Richest Type of Accountant?

That would definitely be a chartered Accountant. They are an even more highly trained financial expert (than for example a public accountant). They’re skilled in managing money, checking financial records, and giving advice on taxes and finances. They help businesses keep their money matters accurate and make smart financial choices.

Keep reading because I will delve deeper into chartered accounting’s earnings, in this article.

So what are the factors influencing an accountant’s earnings you may ask? Let’s delve into that topic.

Are Accountants Financially Educated?

Factors Influencing Accountant Earnings

- Education and Experience: Becoming a chartered accountant or earning a CPA license involves significant educational investment. Many accountants start with a bachelor’s degree in accounting or a related field and then proceed to obtain a CPA license. This education and certification process enhances their earning potential significantly.

- Moreover, I should mention that accountants who hold special qualifications, like being a Certified Information Systems Auditor (CISA) or a Certified Management Accountant (CMA), usually earn more money. This is because they have extra advanced skills and know a lot about their field.

Just remember that financial literacy will significantly boost your earnings.

- Moreover, I should mention that accountants who hold special qualifications, like being a Certified Information Systems Auditor (CISA) or a Certified Management Accountant (CMA), usually earn more money. This is because they have extra advanced skills and know a lot about their field.

- Industry Specialization: Accountants who specialize in certain industries like real estate, investment, or business consulting tend to earn higher salaries due to their niche expertise and ability to provide valuable insights into complex financial matters.

- For instance, real estate accountants are in high demand due to the complexities of property transactions, lease agreements, and tax implications within the industry. Their expertise allows them to offer insights that can directly impact a company’s bottom line.

Is Accounting Hard If You’re Bad At Math?

Accounting might seem tough, especially if math isn’t your strong suit. I get it, and even though accounting involves money matters, basic math skills are important for the job.

But don’t worry if math isn’t your thing – there are computer programs that can do the math part for you. In accounting, you also need to understand how businesses work and analyze numbers, which doesn’t always require math skills.

If you’re struggling, there are online tutors and accounting classes that can help you with the math side of things. It’s all about finding the right support for what you need.

Will an Accountant Ever Be Rich?

As accountants gain experience and climb the career ladder, their earning potential grows substantially. Entry-level positions lay the groundwork, but real financial growth occurs as accountants move into management and senior roles.

This progression often brings more responsibility, leadership opportunities, and, of course, higher salaries.

Can an Accountant Be A Millionaire?

To answer in short: Few do, and some don’t.

It is possible for accountants to become millionaires, just like any other profession. Although it may depend on various factors such as their level of education, experience, skills, and the industry they work in.

You could aim for top roles like becoming the Chief Financial Officer (CFO) of a big, publicly-traded company or a senior leader at a major accounting firm like the Big 4. These roles often come with the highest pay in the accounting field. It might take over 20 years to reach there, but you have to begin somewhere (usually at lower levels).

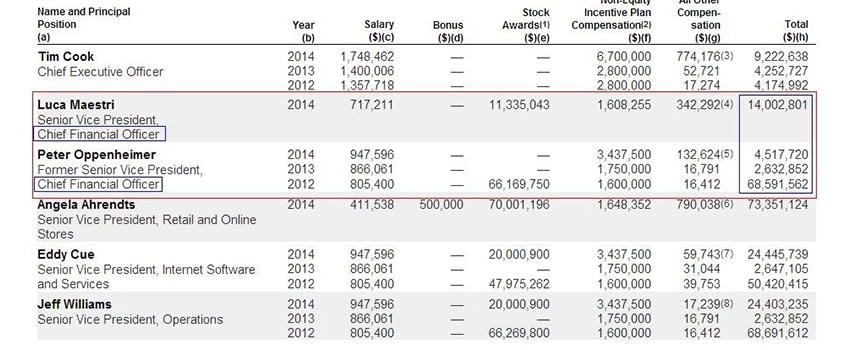

For instance, let’s take a look at the pay of the CFO at Apple, Inc.:

For example, a Chartered Accountant with around 5 to 7 years of experience can earn an annual salary of $100,000 or more. This is where the hard work, dedication, and investment in education start to pay off, allowing accountants to reap the benefits of their expertise.

Are Chartered Accountants Rich?

Yes, chartered accountants are among the well-paid professions, and their potential for wealth is considerable. However, not all chartered accountants become millionaires due to variations in salaries based on location, industry, experience, and education (as mentioned earlier in this post).

Achieving true wealth also depends on financial literacy skills like investing, saving, and smart budgeting.

Factors Influencing Chartered Accountants’ Income

Chartered accountants’ salaries can differ significantly based on various sectors and industries in the United States. For instance:

- Accounting, Tax Preparation, and Bookkeeping: $86,650

- Management of Companies and Enterprises: $84,820

- Other Investment Pools and Funds: $83,760

- Real Estate: $82,090

- Local Government: $73,860

Accountants specializing in tax preparation and related services tend to earn the highest, with an average annual salary of $86,650.

The Path to Becoming a Chartered Accountant

While chartered accountants can earn substantial incomes, the journey involves educational costs. To become a Chartered Accountant, you’ll need an accounting degree and a Certified Public Accountant (CPA) certification.

The cost of CPA preparation courses ranges between $1,500 and $3,500, in addition to exam fees and licensing costs ($500 – $1,500).

Can Accountants Become Millionaires?

Chartered accountants have the potential to earn a lot of money and even become millionaires because of their skills and earnings.

But remember, while accounting can make you financially successful, it doesn’t automatically mean you’ll get super rich.

To truly become wealthy, you’ll need to make smart money choices, work hard, stay committed, and maybe think about well-paying jobs, smart investing, starting your own business, and being careful with spending.

Alternative Streams for Accountant Wealth

Entrepreneurship: Some accountants choose to harness their financial acumen and entrepreneurial spirit by starting their own accounting firms or consultancy services. This allows them to not only earn more but also have control over their work and financial destiny.

Starting an accounting firm comes with its challenges, but it also presents opportunities for accountants to offer specialized services, build their brand, and reap the financial rewards of their hard work.

Investment and Financial Planning: With their deep understanding of financial markets, accountants can venture into investment and financial planning. They can guide clients towards smart investments, managing risks, and optimizing returns, thereby expanding their revenue streams.

Accountants who enter the world of investment often find that their financial expertise gives them a unique edge in identifying lucrative opportunities and ensuring clients’ financial well-being.

Is Accounting A Future Job?

Yes, technical training to help companies maintain and track their financial positions will always be in demand.

You should also take into consideration the rise of Artificial Intelligence (AI) and how it could impact accounting jobs, which I have fully covered in my other article.

Do accountants have a lot of free time?

While the allure of a higher income is compelling, it’s essential to consider the work-life balance that comes with accounting careers. Long hours, especially during tax season, can be demanding. It’s a trade-off that professionals need to navigate while aiming for both financial stability and a fulfilling personal life.

Is accounting a stressful job?

Maintaining a balance between a demanding career and personal well-being is crucial. Accountants can prioritize self-care, time management, and seeking support from mentors or colleagues to ensure they thrive both professionally and personally.

What Are The Disadvantages Of Being An Accountant?

1. Routine Work Might Lack Creativity

Starting out as an entry-level or mid-level accountant often involves working with numbers, data analysis, and statistics. While this can be rewarding, it might not always feel very creative. However, if you enjoy math and want to infuse creativity, you can explore designing visual elements for reports.

Some accounting paths also involve innovative strategies in money management, project funding, and cost-saving ideas.

Pro Tip: Check out ways to boost your creativity in the workplace!

2. Becoming a CPA Takes Time

Becoming a Certified Public Accountant (CPA) is a valuable designation for mid-to senior-level accounting roles. Requirements vary by state and demand a significant time commitment. Typically, you need a bachelor’s degree from an accredited institution and 12 to 30 course hours in accounting and business credits.

Passing a national CPA exam is crucial. If you’re eager to start earning, consider working entry-level accounting jobs while studying part-time.

Explore The ins and outs of becoming a CPA and tips for success!

3. Ongoing Learning Demands

Once you’ve conquered the CPA exam, staying licensed means embracing continuous learning. Each state has unique requirements, often involving annual professional development.

This includes a minimum number of hours in contact or formal education, ethics courses, and technical seminars.

Important!

Conclusion: Are Accountants Usually Rich?

In conclusion, the idea that all accountants are inherently rich is a complex and multifaceted topic. While some chartered accountants and experienced professionals do indeed earn significant incomes, the journey to financial success often requires hard work, strategic career decisions, and patience. It’s crucial to view accounting as a profession that offers rewards beyond just monetary gains.

Share this post on your Social Media Pages!

[…] fresh ideas for engaging project topics or a student aiming to delve into the intricacies of accounting education, this article presents a comprehensive list of 20 captivating project topics that merge […]